What is the MUDRA Bank?

More About the MUDRA Bank...

Press Releases:

PM launches Pradhan Mantri MUDRA Yojana

PM: Combination of integrity with MUDRA – capital - will be the key to success for small entrepreneurs. पूंजी सफलता की कुंजी

The Prime Minister said that in our country, one often experiences that things revolve around mere perceptions, while the details often paint a different picture. Giving the example of the perception that large industries create more employment, he said that a look at the details reveals the reality that only 1 crore 25 lakh people find employment in large industries, whereas small enterprises employ 12 crore people in the country.

The Prime Minister said that while there are a number of facilities provided for the large industries in India, there is a need to focus on these 5 crore 75 lakh self-employed people who use funds of Rs 11 lakh crore, with an average per unit debt of merely Rs 17,000 to employ 12 crore Indians. He said that these facts, when brought to light, led to the vision for MUDRA Bank.

The Prime Minister spoke about his time as the Chief Minister of Gujarat, when he focused on the environment-friendly cottage industry of kite making, which employs lakhs of poor Muslims. He said that he brought a research institute from Chennai on board which discovered that small inputs of skill development were needed in the industry. He said that he felt proud that these small efforts helped the kite-making industry grow from Rs. 35 crore to 500 crores in Gujarat.

The Prime Minister also gave examples of other small businesses that, with a little help, have the potential to grow manifold. He said that the biggest asset of the poor is his / her integrity (imaan). By combining their integrity with capital (MUDRA), it would become the key to their success - पूंजी सफलता की कुंजी. Speaking about women’s self help groups in particular, the Prime Minister said that the kind of honesty and integrity showed by these loan takers is seldom seen in any other sector.

The Prime Minister appreciated the efforts made by the banking sector of India in making Jan Dhan Yojana a success. He said that he envisioned that within a year, banks would queue up to give loans to MUDRA applicants. The Prime Minister also congratulated SIDBI on the silver jubilee of its inception, and appreciated the work done by it in supporting India’s small scale industry in these 25 years.

The Prime Minister said that MUDRA scheme is aimed at “funding the unfunded”. He said that the small entrepreneurs of India are used to exploitation at the hands of money lenders so far, but MUDRA will instil a new confidence in them that the country is ready to support them in their efforts that are contributing so heavily to the task of nation building.

The Prime Minister also spoke about the possibilities of value addition in agriculture. He said that, we must aim at creating a whole network of farmers engaged in value addition at the community level. Brand building, advertising, marketing and financial support, when given to such small entrepreneurs will strengthen the foundation of the Indian economy, he said.

The Prime Minister said that this will not entail any big changes in the existing structures, just a little empathy, a little understanding and a little initiative. He urged the banks to study successful models of microfinance, tailored to the local requirements and cultural contexts, which will be enable us to help the poorest of the poor in a big way.

The Prime Minister said that mere launching of new schemes in not progress. Real success lies in real change on the ground, as was seen in the Jan Dhan Yojana and PAHAL, which had delivered concrete results within limited timeframes, he added. He said that the established financial systems will soon move to the MUDRA-model of functioning, i.e. to support entrepreneurs that give employment to a large number of people using least amount of funds.

The Union Minister of Finance, Shri Arun Jaitley, the Union Minister of State for Finance, Shri Jayant Sinha, and the Governor of Reserve Bank of India, Shri Raghuram Rajan, were present on the occasion.

PM: Combination of Integrity with MUDRA – Capital - Will be the key to Success for Small Entrepreneurs

FM: The Basic Purpose to start the MUDRA Bank was to ‘Fund the Unfunded’

FM: The Basic Purpose to start the MUDRA Bank was to ‘Fund the Unfunded’

The Prime Minister Shri Narendra Modi said that while there are a number of facilities provided for the large industries in India, there is a need to focus on these 5 crore 75 lakh self-employed people who use funds of Rs 11 lakh crore, with an average per unit debt of merely Rs 17,000 to employ 12 crore Indians. He said that these facts, when brought to light, led to the vision for MUDRA Bank. The Prime Minister was speaking after launching the Pradhan Mantri Mudra Yojana and its logo at a well attended function at Vigyan Bhawan here today.

The Prime Minister Shri Narendra Modi said that in our country, one often experiences that things revolve around mere perceptions, while the details often paint a different picture. Giving the example of the perception that large industries create more employment, he said that a look at the details reveals the reality that only 1 crore 25 lakh people find employment in large industries, whereas small enterprises employ 12 crore people in the country. The Prime Minister gave examples of other small businesses that, with a little help, have the potential to grow manifold. He said that the biggest asset of the poor is his / her integrity (imaan). By combining their integrity with capital (MUDRA), it would become the key to their success - पूंजीसफलता की कुंजी. Speaking about women’s self help groups in particular, the Prime Minister said that the kind of honesty and integrity showed by these loan takers is seldom seen in any other sector.

The Prime Minister said that MUDRA scheme is aimed at “funding the unfunded”. He said that the small entrepreneurs of India are used to exploitation at the hands of money lenders so far, but MUDRA will instill a new confidence in them that the country is ready to support them in their efforts that are contributing so heavily to the task of nation building. He said that the established financial systems will soon move to the MUDRA-model of functioning, i.e. to support entrepreneurs that give employment to a large number of people using least amount of funds. The Prime Minister asked the bankers to study the successful micro finance models being followed in other parts of the world and try to adapt them according to the local requirements.

Earlier speaking on the occasion, the Union Finance Minister Shri Arun Jaitley said that this is a historical initiative by the Government to help the micro entrepreneurs to expand their business. He said that 20% of the people are dependent on micro enterprises and most of them are based on self-employment. Shri Jaitley said that the basic purpose to start the Mudra bank was to ‘fund the unfunded’ because these micro enterprises were not getting the due attention which they actually deserve. He said that the Government has already launched various schemes for the poor and vulnerable sections of the society in the form of accident insurance, life insurance and pension schemes, and now trying to ensure that health insurance schemes are also made easily accessible/extended to this section of the society. He said that the policy of the Government to have an industrial corridor will help in providing employment to more than 30 crore landless workers. Shri Jaitley said that under Pradhan Mantri Mudra Yojana, micro entrepreneurs will be sanctioned loans ranging from Rs. 50,000/- to Rs. 10 lakhs.

In his welcome address, Shri Jayant Sinha, Minister of State for Finance said that this scheme has been started on the Pradhan Mantri initiative and is in tune with Sabka Saath Sabka Vikas.

The function was attended among others by Dr. Raghuram Rajan, RBI Governor, Shri Rajiv Mehrishi, Finance Secretary, Shri Ratan P. Watal, Expenditure Secretary, Shri Shaktikanta Das, Revenue Secretary, Dr HASMUKH Aadhia, Secretary, Financial Services, CEOs of various Public Sector Banks and Financial Institutions and representatives of the Micro Finance Institutions from across the country among others.

The Government of India believes that economic growth would be self- sustaining in the long run if it is an inclusive economic growth. According to the NSSO Survey of 2013, there are some 5.77 crore small business units, mostly individual proprietorship, which run manufacturing, trading or services activities. These encompass myriad of small manufacturing units, shopkeepers, fruits / vegetable vendors, truck and taxi operators, food-service units, repair shops, machine operators, small industries, artisans, food processors, street vendors and many others. Most of these ‘own account enterprises’ (OAE) are owned by people belonging to Scheduled Caste, Scheduled Tribe or Other Backward Classes.

While this Non-Corporate Small Business Sector, is one of the largest disaggregated business ecosystems in the world sustaining around 50 crore lives, these hard working entrepreneurs find it difficult to access institutional finance. These entrepreneurs are largely self financed or rely on personal networks or moneylenders.

In order to address the problem of timely and adequate finances to Non-Corporate Small Business Sector, the Union Finance Minister, in his Budget Speech for FY 2015-2016, had proposed the creation of a Micro Units Development Refinance Agency (MUDRA) Bank, with a Refinance corpus of Rs.20,000 crore, and credit guarantee corpus of Rs.3,000 crore. MUDRA is to be set up through a statutory enactment and would be responsible for developing and refinancing all Micro-finance Institutions (MFIs) which are in the business of lending to micro / small business entities engaged in manufacturing, trading and service activities through a scheme namely “Pradhan Mantri MUDRA Yojana”. MUDRA would also partner with State / Regional level co-ordinators to provide finance to Last Mile Financiers of small / micro business enterprises. Further, the approach goes beyond credit only approach and offers a “credit – plus” solution for these enterprises spread across the country. The roles envisaged for MUDRA would include:

· Laying down policy guidelines for micro enterprise financing business

· Registration of MFI entities

· Accreditation /rating of MFI entities

· Laying down responsible financing practices to ward off over indebtedness and ensure proper client protection principles and methods of recovery

· Development of standardised set of covenants governing last mile lending to micro enterprises

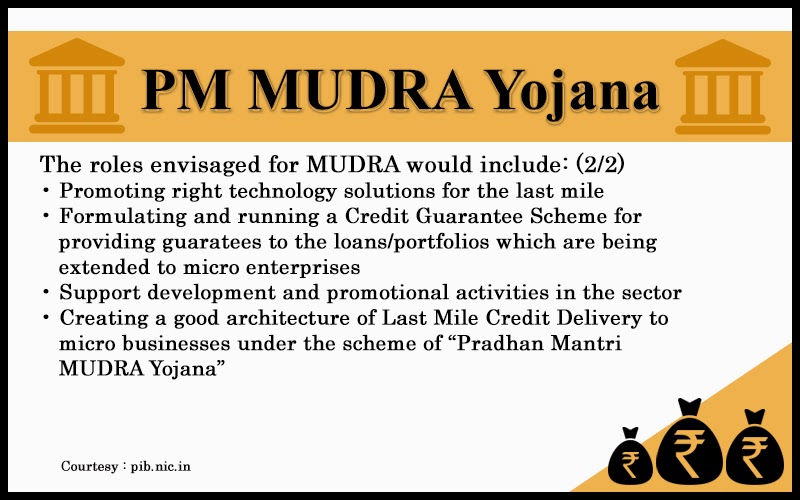

· Promoting right technology solutions for the last mile

· Formulating and running a Credit Guarantee Scheme for providing guarantees to the loans/portfolios which are being extended to micro enterprises

· Support development and promotional activities in the sector

· Creating a good architecture of Last Mile Credit Delivery to micro businesses under the scheme of Pradhan Mantri MUDRA Yojana

The above measures to be taken up by MUDRA are targeted towards mainstreaming young, educated or skilled workers and entrepreneurs. Since the enactment for MUDRA is likely to take some time, it is proposed to initiate MUDRA as a unit of SIDBI to benefit from SIDBI’s initiatives and expertise.

Products and Offerings

The primary product of MUDRA will be refinance for lending to micro businesses/units under the aegis of the Pradhan Mantri MUDRA Yojana. The products would be covered under ‘Shishu’, ‘Kishor’ and ‘Tarun’ category to signify the stage of growth/development and funding needs of the beneficiary micro unit/entrepreneur as also provide a reference point for the next phase of graduation/growth for the entrepreneur to aspire for:

o Shishu : covering loans upto Rs. 50,000/-

o Kishor : covering loans above Rs. 50,000/- and upto Rs. 5 lakh

o Tarun : covering loans above Rs. 5 lakh and upto Rs. 10 lakh

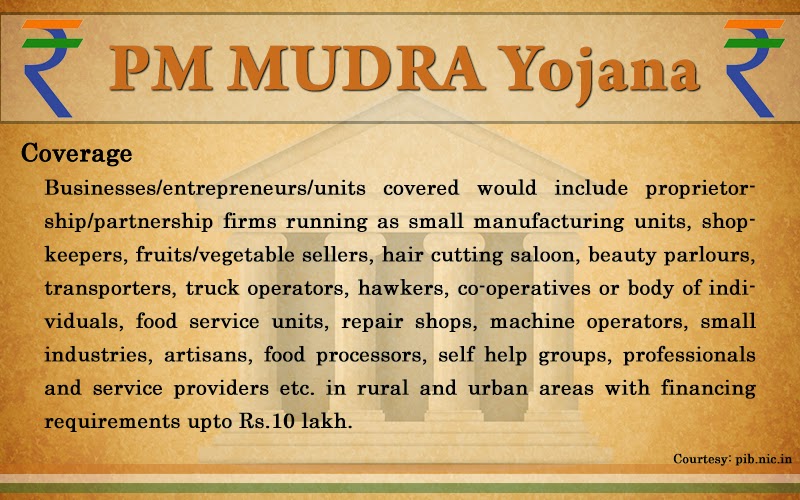

Businesses/entrepreneurs/units covered would include proprietorship/partnership firms running as small manufacturing units, shopkeepers, fruits/vegetable sellers, hair cutting saloon, beauty parlours, transporters, truck operators, hawkers, co-operatives or body of individuals, food service units, repair shops, machine operators, small industries, artisans, food processors, self help groups, professionals and service providers etc. in rural and urban areas with financing requirements upto Rs.10 lakh.

The products initially being launched are as under:

· Sector / activity specific schemes, such as, schemes for business activities in Land Transport, Community, Social and Personal Services, Food Product and Textile Product sectors. Schemes would similarly be added for other sectors/activities.

· Micro Credit Scheme (MCS)

· Refinance Scheme for Regional Rural Banks (RRBs)/Scheduled Co-operative Banks

· Mahila Uddyami Scheme

· Business Loan for Traders and Shopkeepers

· Missing Middle Credit Scheme

· Equipment Finance for Micro Units

Credit Plus Approach

MUDRA would also adopt a credit plus approach and take up interventions for development support across the entire spectrum of beneficiary segments. The highlights of such proposed interventions/initiatives are as under:

· Supporting financial literacy

· Promotion and Support of Grass Root Institutions

· Creation of Framework for “Small Business Finance Entities”

· Synergies with National Rural Livelihoods Mission

· Synergies with National Skill Development Corporation

· Working with Credit Bureaus

· Working with Rating Agencies

Other Proposed Offerings: In addition to the offerings mentioned in above paras, following facilities are also envisaged :

· MUDRA Card

· Portfolio Credit Guarantee

· Credit Enhancement

MUDRA will build on experiences of some of the existing players, who have demonstrated ability to cater to the Non Corporate Small Business segment to build a financing architecture and right ecosystem for both the entrepreneurs as well as the last mile financiers to the segment. Access to finance in conjunction with rational price is going to be the unique customer value proposition of MUDRA. The establishment of MUDRA would not only help in increasing access of finance to the unbanked but also bring down the cost of finance from the Last Mile Financiers to the informal micro/small enterprises sector. The approach goes beyond credit only approach and offers a credit – plus solution for these myriad micro enterprises, creating a complete ecosystem spread across the country.

*******

Courtesy pib.nic.in

No comments:

Post a Comment